Annual DRAM/NAND revenue expected to increase in 2022

🟩 Memory semiconductors are expected to increase sales in 2022

According to TrendForce, DRAM and NAND memory semiconductors are expected to increase sales in 2022, respectively.

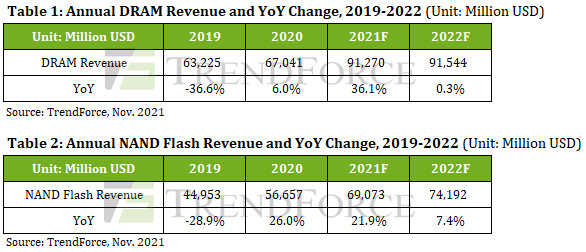

DRAM: 0.3% increase @ 2022

In 2022, DRAM annual revenue is expected to be $91.54 billion, an increase of 0.3% year-over-year.

NAND: 7.4% increase @ 2022

In 2022, NAND Flash is expected to reach USD 74.19 billion, up 7.4% year-on-year.

🟩 Memory prices fall due to supply > demand

The global memory market is expected to shift from a shortage situation to an oversupply. This is because we maintain a relatively high level of DRAM inventory.

DRAM: Supply+18.6% > Demand+17.1% @2022

We predict a 15% year-over-year decrease in DRAM prices in 2022. Because the total supply will increase by 18.6% YoY, but DRAM demand is also expected to increase by only 17.1% YoY in 2022.

NAND: Supply+31.8% > Demand+30.8% @2022

2022 NAND Flash price predicts a 18.0% year-on-year decline. This is because NAND supply will increase by 31.8%, but demand will only increase by 30.8%.

🟩 Factors contributing to increased memory supply

Memory companies are increasing capital expenditures by 40% of sales to increase the supply of DRAM and NAND.

DRAM: EUV Implementation

DRAM manufacturing technology is approaching a physical bottleneck. Since the process nodes of advanced products have shrunk to below the 20nm level, the improvement in integration is limited. That’s why Samsung and SK Hynix are already using EUV lithography technology.

NAND: 3D NAND lamination

3DNAND lamination technology currently has about 100 layers to increase productivity. In addition, we are developing products at the level of 200 layers, which is expected to further improve productivity.

🟩Summary

2022 DRAM/NAND will decrease in price, but annual revenue growth due to increased supply

As DRAM is approaching the limit of miniaturization development, companies such as Samsung, SK Hynix, and Micron, which are large in scale and can also invest in EUV, are likely to become even more oligopolistic. NAND is still expected to improve productivity with multilayer technology, and I hope that Japan KIOXIA will keep up with the development competition.