EVs and autonomous driving will drive demand, but not enough to lead the semiconductor market

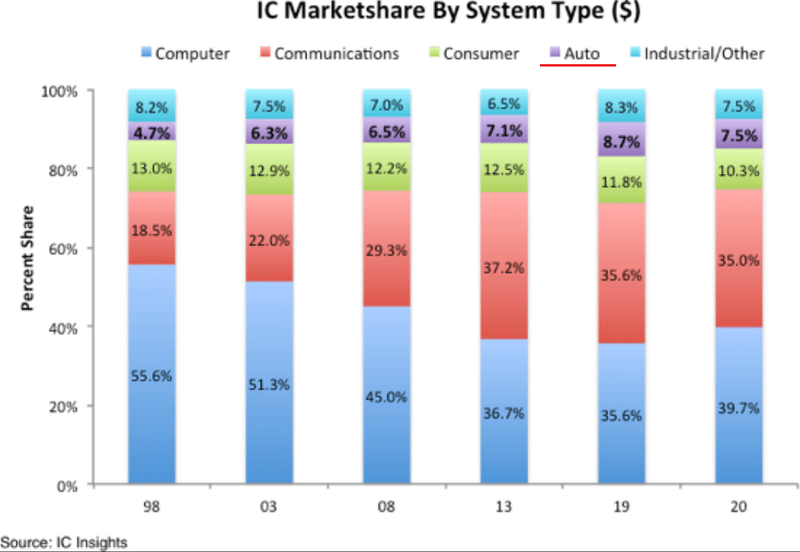

🟩 Automotive applications account for less than 10% of the entire semiconductor market

Automotive ICs are steadily increasing, but have not yet exceeded 9% of the overall semiconductor market.

In other words, automotive applications account for less than 5% of TSMC, the world’s largest foundry, which accounts

for only a fraction of the sales of many IC suppliers.

🟩Can growth be expected in EV & autonomous driving?

The automotive IC market is expected to surge by more than 25% in 2021

, but with the global IC market expected

to increase by 24%, the share of the total market will not change significantly.

This means that EV & autonomous driving will surely spread and grow, but

the growth rate of the semiconductor market as a whole will also be high.

🟩 Are automotive semiconductors attractive?

Automotive ICs don’t require state-of-the-art technology Legacy 200mm

wafers must ensure longevity while adhering to even more stringent reliability and test requirements

In addition, since it is difficult for automakers to negotiate prices, the average selling price of products seems to be kept almost constant despite the shortage of in-vehicle ICs, and the average selling price of the market as a whole has

increased by +2% due to the shortage of semiconductors.

It is not possible to use advanced technologies with high profit margins, it is difficult to improve processes to maintain strict reliability, and price negotiations are strict、、、 IC manufacturers may not be very attractive.

🟩Summary

News of the shortage of automotive ICs is often covered, but it will take a long time for automotive ICs to significantly increase the growth rate of the overall IC market.

Rather, in order for automobiles to lead the growth of the semiconductor market, it may be necessary for

automakers to respond

closely to semiconductor manufacturers, such as adopting advanced technologies and negotiating prices.