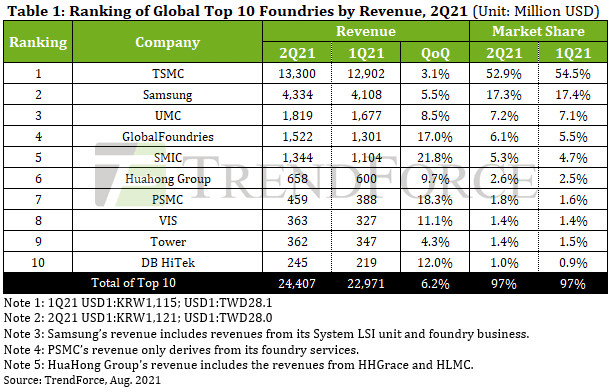

the global semiconductor foundry industry grew by 6.2% in the second quarter, record sales

🟩TSMC AND SAMSUNG DROP SHARES

According to TrendForce, worldwide semiconductor foundry sales reached $24.5 billion in the second quarter of 2021, a record high since the third quarter of 2019. Factors such as the transition to 5G technology, geopolitical tensions, and chip shortages are factors that contribute to the movement of semiconductor purchases and the price increase of wafers. This indicates that there is still a lot of demand for semiconductor foundries.

ON THE OTHER HAND, TSMC, WHICH HAS AN OVERWHELMING GLOBAL SHARE, AND SAMSUNG ELECTRONICS CO., WHICH RANKED SECOND, DROPPED THEIR MARKET SHARE.

🟩 temporary production decline due to the impact of disasters

SALES OF BOTH TSMC AND SAMSUNG ELECTRONICS INCREASED 3.1% AND 5.5% QUARTER-ON-QUARTER. HOWEVER, COMPARED TO OTHER FOUNDRIES, GROWTH WAS SLIGHTLY LOWER AND WE LOST MARKET SHARE AGAINST OUR COMPETITORS.

TSMC

tainan fab was affected by power outages in april and may. one of the reasons for this reduction is the disposal or rework of some wafers on the 40nm and 16nm nodes.

samsung electronics

austin-based fabs were affected by the texas cold wave in february. fab reopened in april and is now at full capacity. however, a sharp decline in wafers in the first quarter damped sales growth in the second quarter.

🟩 summary

demand for semiconductor funds will continue for some time.

TSMC AND SAMSUNG ELECTRONICS HAVE TEMPORARILY DROPPED THEIR SHARE, BUT THE SHARE OF THE TWO COMPANIES WILL NOT CHANGE MUCH FOR SOME TIME.