In 2020, the semiconductor production capacity of Japan was the third largest after Taiwan and South Korea.

🟩Will it be overtaken by China in 2021?

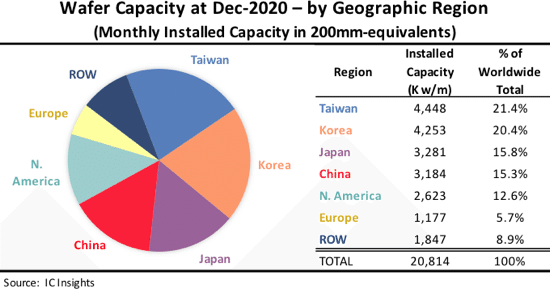

IC Insights’ semiconductor production capacity report is a ranking of the production capacity of countries with factories, regardless of the location of the headquarters of the companies that own the factories. For example, semiconductors produced by South Korea-based Samsung Electronics in its U.S. plant count toward its North American production capacity, not South Korea.

As of the end of 2020, Taiwan, which has a monthly wafer production capacity of 4.45 million wafers, ranks first. Following South Korea in second place Japan is in third place with 3.28 million copies per month, which is almost the same as China in fourth place, but narrowly higher.

The ROW region mainly consists of Singapore, Israel, and Malaysia.

🟩 China is increasing production

China surpassed its manufacturing capacity in Europe in 2010, the ROW region in 2016, and North America in 2019. China’s semiconductors have grown rapidly over the past decade. It is expected to surpass Japan in 2021 and is the only region to increase its share of production capacity from 2020 to 2025.

🟩 Production volume in each region

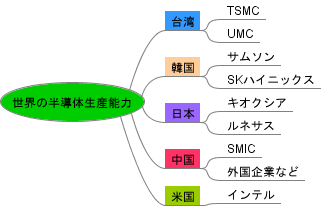

Top 5 semiconductor production capacity and major semiconductor manufacturers in the world

Taiwan

TSMC, the world’s largest contract manufacturer of logic chips, and UMC, the manufacturer of DRAM, account for 21.4% of the world’s total. It became the largest production capacity in 2011, Japan surpassing South Korea in 2015. In terms of forecasts to 2025, it is expected to remain the largest region in the world.

Korea

It is home to the world’s largest manufacturers of NAND and DRAM memory, including Samsung Electronics and SK Hynix, and ranks second with 20.4% of the world’s wafer manufacturing capacity. When it comes to 300mm wafers, South Korea leads the pack, followed by Taiwan.

Japan

Japan companies no longer produce state-of-the-art logic chips, but they do have the world’s largest 2D/3D NAND production facilities operated by KIOXIA and Western Digital. Moreover, companies like Renesas still produce chips for various industries, and there are numerous semiconductor factories in the country.

China

In line with the “Manufacturing China 2025” policy, DRAM and NAND fab investments are progressing on a large scale. However, China is expected to import a large amount of semiconductors in the coming years. This is because the majority of logic chips made in China are manufactured on nodes prior to the 28nm process, so advanced chips will have to rely on imports for a while.

United States

The share of North America’s production capacity is projected to decline as the large fabless supplier industry in North America continues to rely primarily on foundries based in Taiwan. However, U.S. companies with fabs in the U.S., such as Intel, manufacture expensive and high-margin logic chips.

🟩Summary

2021 Japan semiconductor production capacity will be overtaken by China

China is increasing its semiconductor manufacturing capabilities, but does not yet have the technology for cutting-edge processes. Taiwan, South Korea and the United States are said to be at least five years behind. Japan is already lagging behind China in advanced processes, so it seems that a different strategy from Taiwan, South Korea, and the United States will be necessary.