Meteoring with enterprise SSDs! Consumer sales are sluggish

🟦NAND Flash Pricing @ Q3 2024

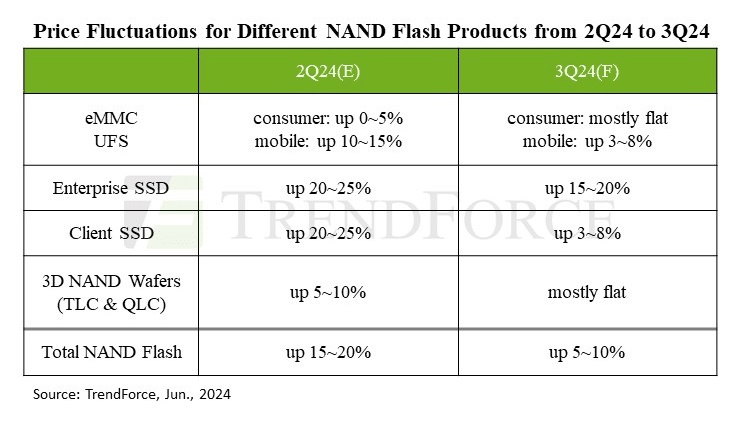

According to TrendForce, NAND flash sufficiency is expected to rise to 2.3% in Q3 as NAND suppliers aggressively ramp up production in the second half of 2024, and the compound price increase is expected to be limited to 5~10%. In the first half of 2023, NAND flash prices rebounded strongly as manufacturers curbed production and regained profitability. However, since then, prices have been on a downward trend due to increased production and sluggish demand.

🟦Rapid rise in corporate demand due to special demand for AI, slowing price increases in smartphone inventories

NAND flash supply is becoming excessive due to increased production. As we continue to invest in AI for the enterprise, the demand for SSD for servers is growing. Consumer demand has been sluggish, especially in the PC market, which was affected by price increases at the end of last year. For smartphones, UFS stocks are ramping up, and therefore resisting price increases.

Q3 NAND Flash Price Outlook

- Enterprise SSDs: 15~20% increase

- SSD for PC: 3~8% increase

- UFS: 3~8% increase

- eMMC: Unchanged

🟦Summary

NAND flash prices are trending downward due to oversupply, but prices continue to rise in some high-demand areas. While the enterprise market is doing well due to the expansion of AI adoption, the consumer market continues to be sluggish.

The evolution of AI has had a significant impact on the entire semiconductor industry. In addition to GPUs, the demand for DRAM, NAND, etc. is also increasing, driving new growth in the semiconductor market.