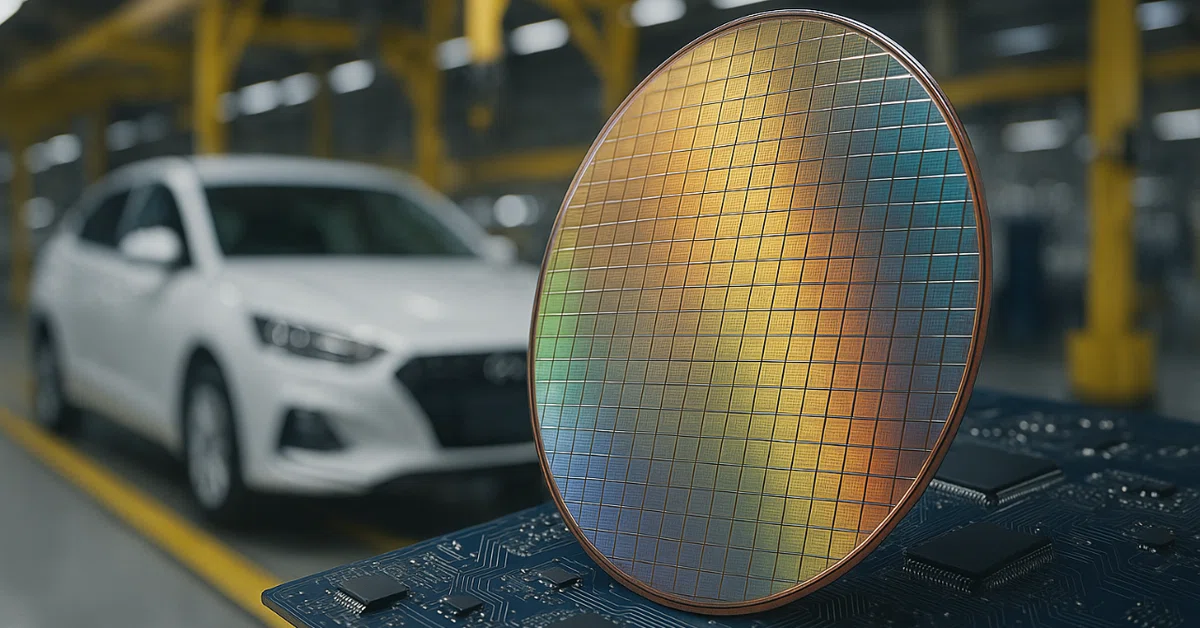

Hyundai Mobis announced its intention to expand its automotive semiconductor business in earnest from 2025 to strengthen profitability and global expansion, focusing on its in-house designed communication SoCs and power semiconductors.

🟦 Hyundai Mobis to strengthen its automotive semiconductor business in earnest

Hyundai Mobis will strengthen its business with a focus on system semiconductors and power semiconductors in anticipation of the spread of software-defined vehicles (SDVs). It plans to mass-produce approximately 20 million semiconductors per year by 2025, and next-generation semiconductors are also under development.

- Key Contents

of the Announcement ・Secured in-house design capabilities for communication SoCs and BMICs, and integrated SDV control networks into a single chip.

・A total of 16 types of semiconductors, including airbags, motor controls, and AVNs, are being mass-produced at an external foundry.

・Approximately 20 million semiconductors are scheduled to be produced in 2025, and 11 more next-generation products will be developed. - Technical Features and Advantages

・Improved control efficiency and safety through SoC integration.

・Enhanced reliability with ISO 26262-compliant design.

・Directly responding to the EV market by accelerating mass production in the power semiconductor field. - Target markets and applications

: Major OEMs in North America and Europe, and automakers promoting autonomous driving and electrification.

・We are also looking at expanding orders in emerging markets such as China and India.

🟦The SDV era and the acceleration of semiconductor in-house manufacturing

The automotive industry is accelerating the trend of “software-defined vehicles (SDVs)”, and it is inevitable that the complexity of control systems and the surge in demand for semiconductors will increase. Even in areas that have traditionally relied on external suppliers, automakers and major suppliers are increasingly promoting in-house production. Hyundai Mobis’ strategy responds to this trend, especially in power semiconductors and automotive SoCs, which competitors such as Bosch, Denso, and Infineon are also focusing on.

🟦 Summary

Hyundai Mobis has a business strategy that combines system semiconductors and power semiconductors, and aims to achieve large-scale mass production and increase profitability from 2025 onwards. The medium- to long-term goal of 40% of overseas customer sales is a challenge to increase our presence in the global market.

Auto parts suppliers are also starting to focus on in-house production of semiconductors in order to differentiate themselves. As with automakers, “holding chips” is becoming a source of competitiveness, and I feel that this is an inevitable trend in the era of software-defined vehicles (SDVs).