There will be no "big deal" in 2021 like in 2020

🟩 M&A in the semiconductor industry in the first half of the year is lower than last year

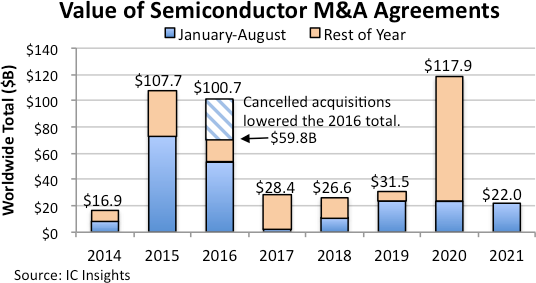

According to a report by IC Insights, the pace of M&A in the semiconductor industry is sluggish without the “big deals” seen in 2020. The total value of semiconductor M&A deals in the first half of 2021 was $22 billion, slightly below the total for the same period in 2019 and 2020.

M&A in the semiconductor industry is centered around companies driving industrial IoT, robotics, autonomous vehicles, artificial intelligence (AI) and machine learning, image recognition, and 5G networks.

🟩”Big deal” for 2020

In the second half of 2020, there was a sharp increase in the number of M&A announcements of semiconductors. After the business situation stabilized from the pandemic situation in the first half of the year, four “big contracts” were announced in September-December.

NVIDIA →ARM 4.4 trillion yen

GPU company NVIDIA has announced the acquisition of CPU IP company ARM for $40 billion.

AMD →Xilinx 3.9 trillion yen

CPU company AMD announced a $35 billion acquisition of FPGA company Xilinx.

Marvell → Inphi 3.9 trillion yen

Networking IC company Marvell Technology (MRVL) has completed its acquisition by announcing a $10 billion acquisition of wireless communications IC company Inphi.

What kind of company is Marvell?What kind of company is Marvel? We will answer that question. Easy-to-understand and careful explanations of the company’s history, products, growth potential, annual income, stock price, etc.dopodomani.biz

SKHynix →Intel (NAND) 1 trillion yen

CPU company Intel (Intel) has announced the sale of its NAND flash business and China’s 300mm fab to South Korean memory company SKHynix for $9 billion.

Three of the four 2020 “big contracts” are still awaiting regulatory approval.

🟩What are the predictions for the rest of 2021?

If, as in the previous year, a “big deal” is reached in the 2021 remnants, the amount of M&A could increase significantly. Some have been rumored in the press.

Intel →GlobalFoundries 3.3 trillion yen

CPU company Intel is in talks to acquire semiconductor foundry GlobalFoundries for about $30 billion. This is to bolster Intel’s new wafer foundry, IDM2.0.

Western Digital → Kioxia 2.2 trillion yen

NAND memory company Western Digital is exploring the possibility of a merger of Kioxia in excess of $20 billion. Kioxia is a Japan company, the former Toshiba Memory spin-off, and is still a partner of Western Digital.

However, GlobalFoundries and Kioxia are believed to be in the process of an initial public offering (IPO) scheduled for Q4 2021.

🟩Summary

Semiconductor M&A in 2021 is a situation where there are no “big deals”, but it may be in the rest of this year.

When productivity increases through corporate mergers, there are also benefits for users who use semiconductors, so it is good for companies to be organized in an appropriate competition.